Microwritings on the Wall

Money is moving. The election cycle always causes capital markets to move, and money indeed is moving.

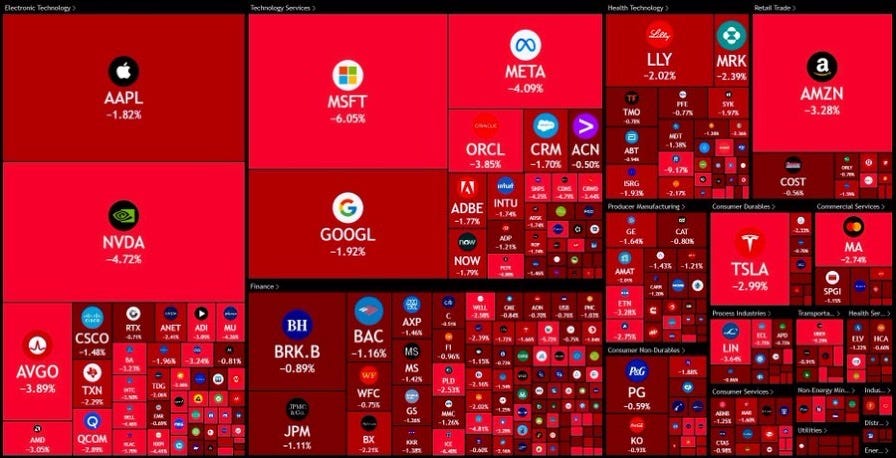

Along with the news of $953 billion lost in American capital markets, two stories caught my eye this week.

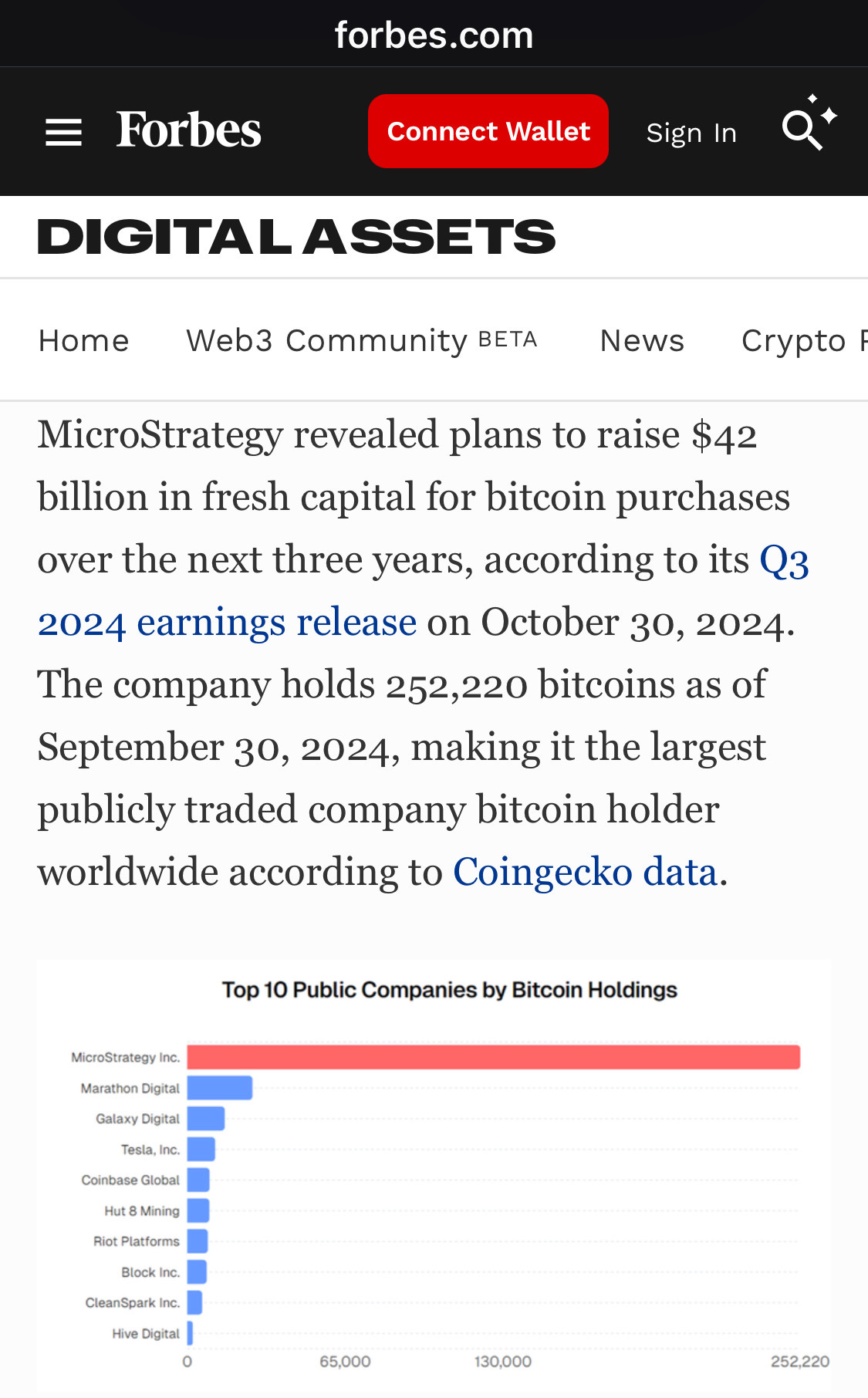

One story deals with Microstrategy ($MSTR) acquiring more Bitcoin, which isn’t news to anyone in my industry because Michael Saylor is a Bitcoiner with an insatiable appetite for buying more. The thing that caught my eye was the fact that Microstrategy, a self proclaimed Bitcoin development company that wants to become a Bitcoin bank, has announced a plan to raise $42 billion to acquire Bitcoin. This is ambitious and revolutionary, especially when you consider the fact that the current Bitcoin holdings of Microstrategy is above multi billions in unrealized profit.

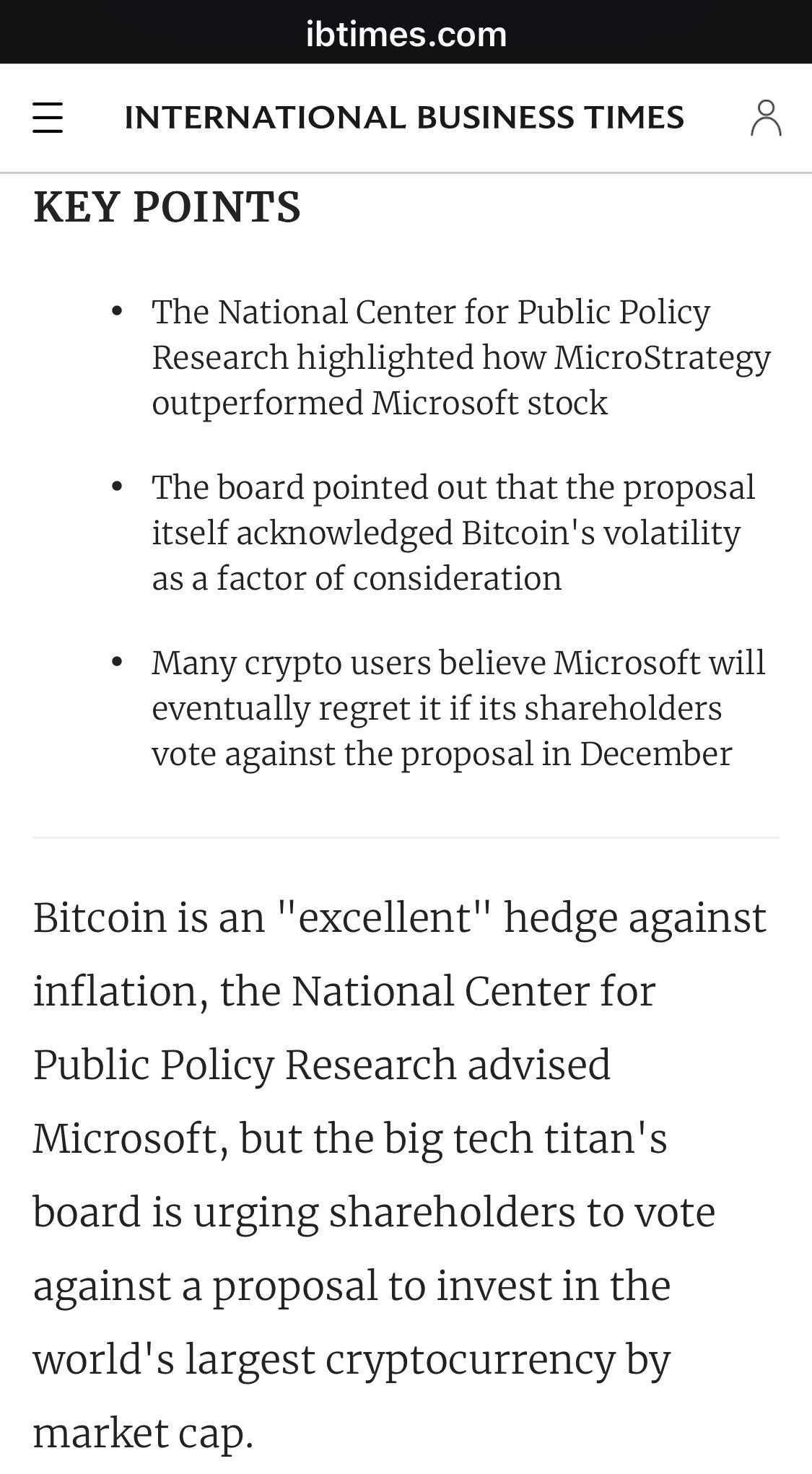

The other story that caught my eye was the fact that Microsoft ($MSFT) is voting on whether they should hold Bitcoin as a company. This is unprecedented because Microsoft is among the darlings of the old era of money. Microsoft sits within baskets of other stocks that have been accepted as premier investment instruments to hold long-term. If Microsoft joins the ranks of Wisconsin and holds Bitcoin, by proxy via a Bitcoin ETF or holding actual Bitcoin in a corporate multi-signature cold storage wallet, this is going to start a cascading effect beyond what has already hit Wall Street. So, what does this mean for everyone else?

The writing is on the wall and time for the “little guys” to acquire Bitcoin is running out.

The titans of industry and the behemoth of capital markets alike want to sit at Bitcoin’s table now. Like venture capitalists, when it comes to making an investment, no one wants to be first, yet no one wants to be last. The race is on.

Who will be last to Bitcoin’s party? Because the party is growing now.

— Christopher Perceptions