How To Make A Bitcoin Treasury (Pt. 2)

This is for private citizens looking to make a BTC (Bitcoin Treasury Company)

So, you want to start a Bitcoin treasury company? Let’s talk about structures!

Last week, I spoke on the ethos of what a Bitcoin treasury company actually is, but now, let’s unpack the mechanics of how to structure a Bitcoin treasury company.

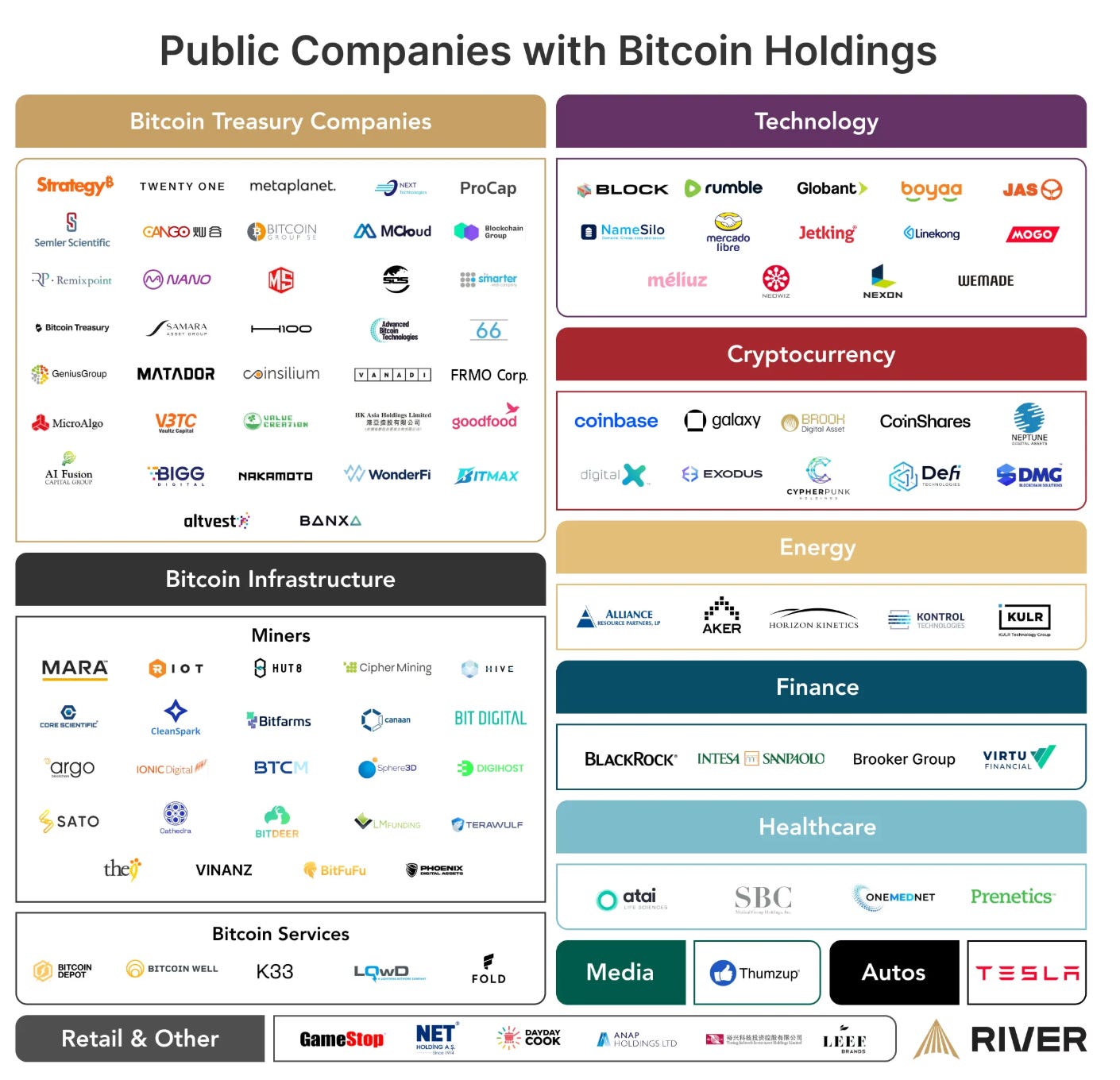

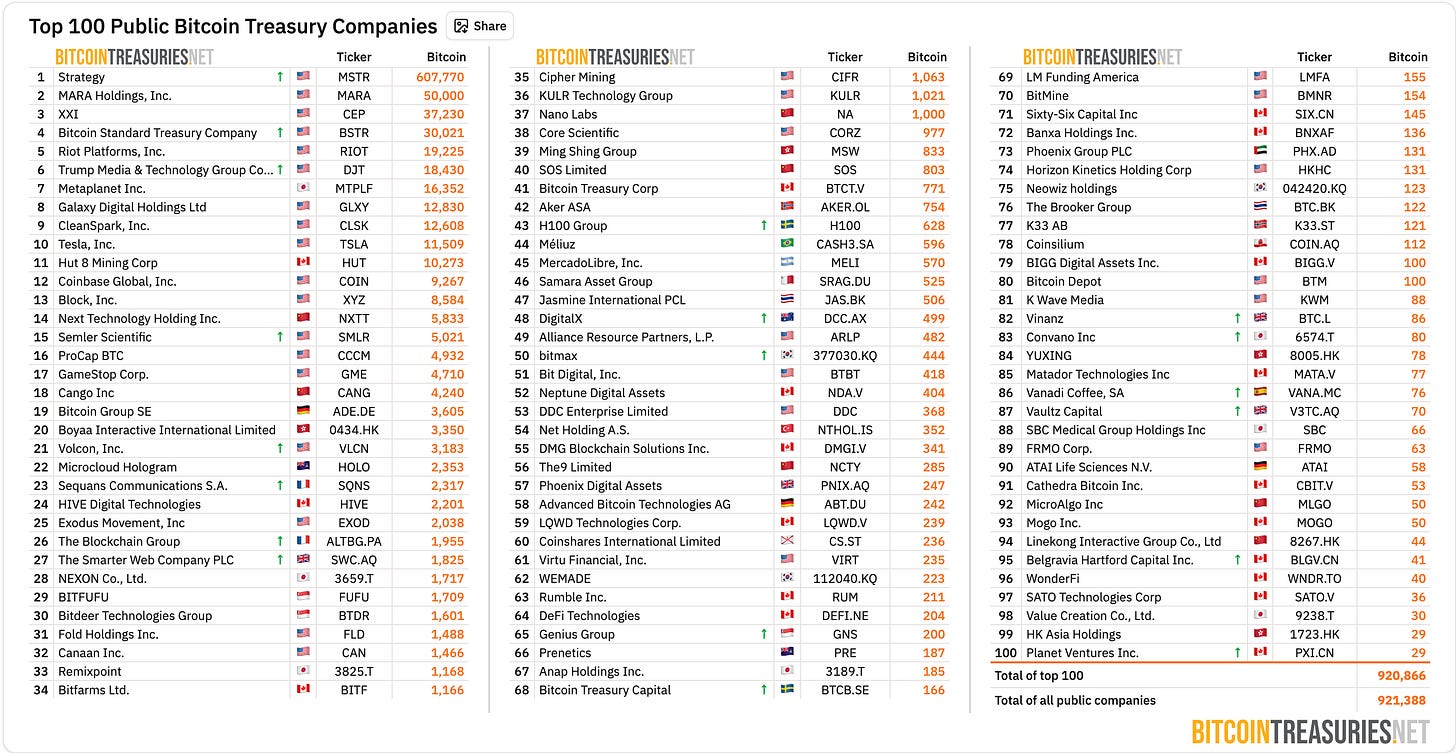

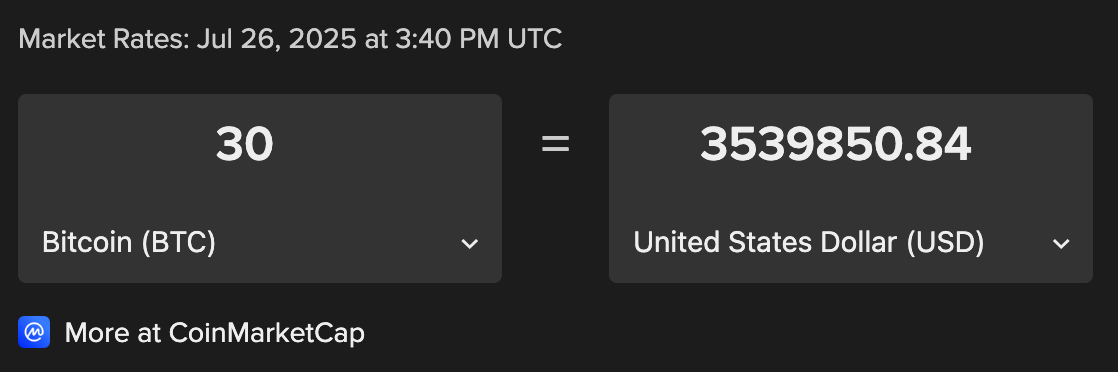

In order to be a Bitcoin treasury company, you need a thesis and a legal way to acquire Bitcoin through a corporate vehicle. While defining a thesis may be nuanced, it ultimately is your company’s “why” and “how” concerning its Bitcoin acquisition strategy. It’s also worth noting that you don’t need a mountain of capital to start. As BitcoinTreasuries.net shows, you only need 30 BTC to be in the top 100 public Bitcoin treasury companies at the time of this being published. While (Micro)Strategy has over 600K BTC worth several billions, 30 BTC is less than $4M at the time of this publishing. If you wish to leverage the press that comes with being a top 100 Bitcoin treasury company, you can create a strategy for your entity to acquire 30 BTC in a short amount of time. Now the question remains: what’s the best structure for you?

If you are a private citizen who doesn’t have 30 BTC lying around, how can you set up a structure where you can do this? Let’s explore what’s possible with a Wyoming LLC.

This is the part of the newsletter where I say this is not financial advice. Ready? Ahem:

This is NOT financial advice.

Great. Now, let’s have a conversation about insights and what’s possible in general. If you are interested in strategy sessions about Bitcoin treasuries or Bitcoin in general, click here and book a private Bitcoin strategy session with me. Pay via BTC or PayPal.

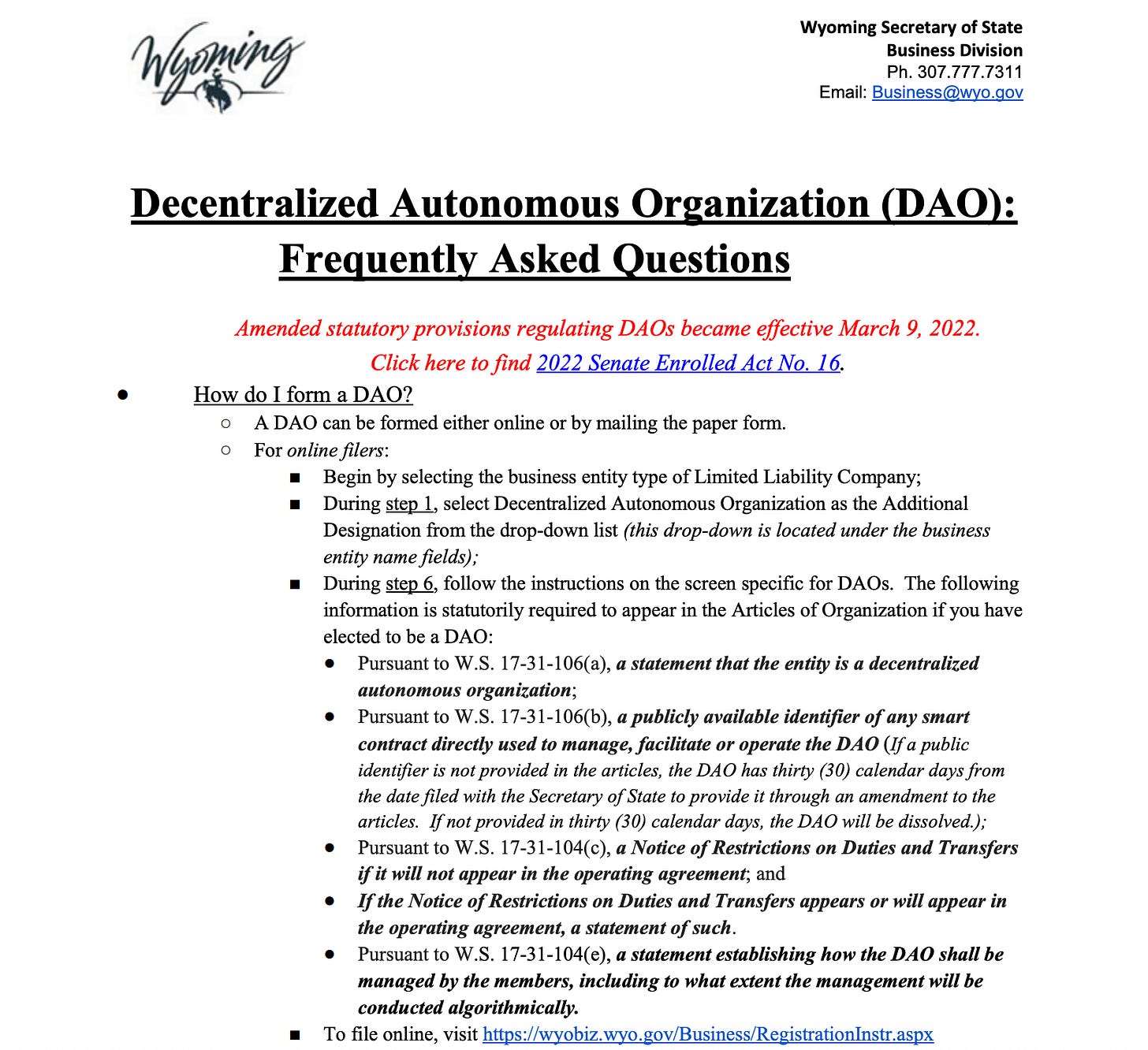

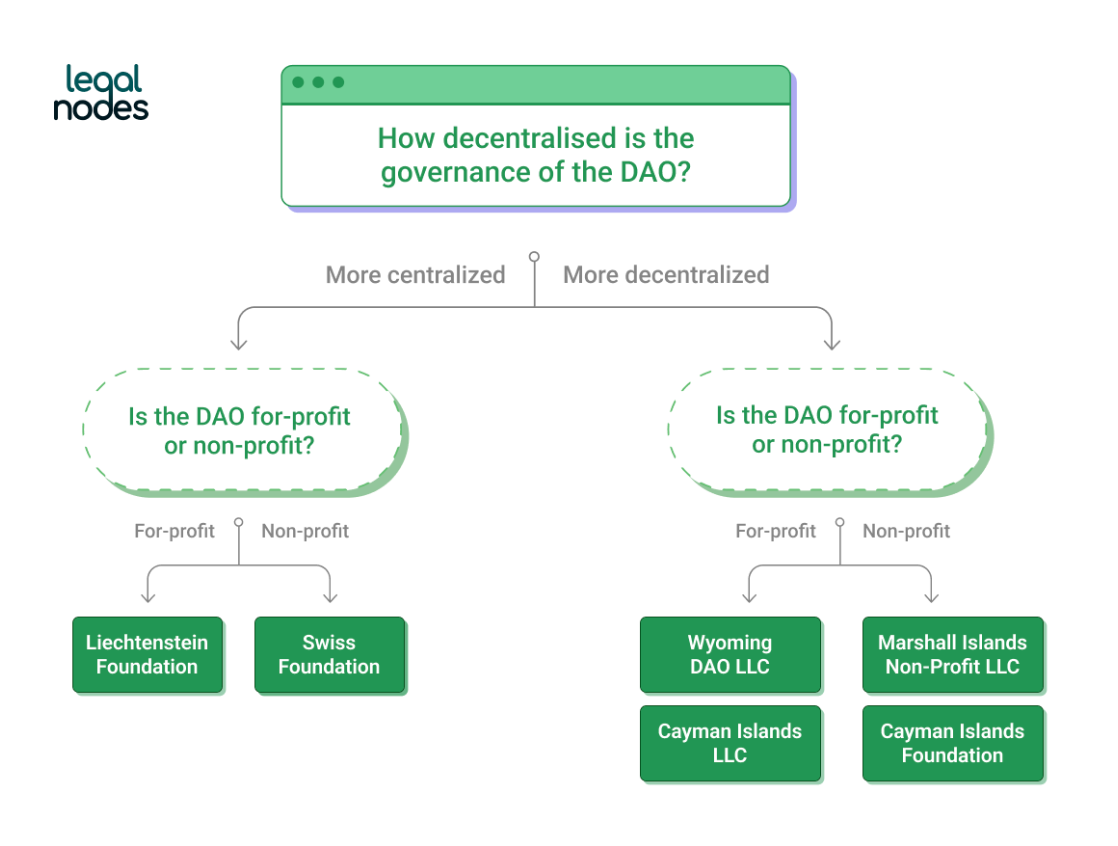

If I wanted to start a Bitcoin treasury company, I would look at Wyoming, and I would look at a DAO structure as a private citizen. A DAO, also known as a decentralized autonomous organization, is recognized as a legal entity in the state of Wyoming, and it shields members from personal liability for any DAO obligation. DAOs are viewed as a special kind of LLC, which can be managed through smart contracts or Bitcoin multisignature wallets. DAO LLCs have to disclose governance smart contracts or Bitcoin multisignature wallet addresses in their Articles of Organization for the sake of building trust for any investors that may be interested in investing. The only catch is DAO LLCs dissolve automatically if no actions around governance occur for 365 days, which could pose a risk for passive treasuries that simply buy and hold. There is also the element of the Corporate Transparency Act, mandating member disclosure, meaning anonymity may be reduced. See why I said this is not financial advice? Every situation would be different. One huge benefit for DAO LLCs would be the fact that Wyoming has 0% corporate tax, but only DAO LLCs enable pass-through taxation, making profits taxed only at the member level, which keeps double taxation from taking place. You could not take advantage of this with a regular WY LLC. Cool, right?

Speaking on taxes, it’s worth noting that the IRS views Bitcoin as “property” and says treasuries are subject to mark-to-market accounting. Unrealized losses in the treasuries can offset gains, and holding for at least 1 year qualifies for 15%-20% long-term capital gains. Wyoming also has 0% state tax on Bitcoin appreciation, and treasuries have the ability to sell depreciated BTC in December and then repurchase after 30 days. If there is a mining element to the Bitcoin treasury, rewards are taxed as ordinary income at fair market value! Post-acquisition gains are seen as capital gains. Lastly, a private citizen could look at self-directed IRAs for tax-deferred Bitcoin accumulation. A person could even leverage IRS Section 351, which states that a person could contribute Bitcoin to the newly formed Bitcoin treasury company tax-free in exchange for equity! So if you have Bitcoin, you could transfer it to the Wyoming DAO LLC, for example, but what if you don't have several Bitcoin sitting somewhere? Capital raising can happen via convertible debt, tokenized promissory notes, equity swaps, and even crowdfunding. Basically, this is a great time to be interested in establishing a Bitcoin treasury company, as things are more welcoming.

After this, a private citizen would have to look into custody, security, treasury management, and scaling. We will explore these options in the final installment.

SPAC, SPV, and DAO LLC—all of the letters can lead to BTC in a BTC (Bitcoin treasury company). These are very exciting times for Bitcoin in general.

With that said, does anyone want to start a Bitcoin treasury company with me? :-)

Stay tuned for Part III next week. Until then, peace, love, and seek Christ.

— Christopher Perceptions, TwentyOneSociety.com 🟧