Ever since the advent of MicroStrategy, Bitcoin treasury companies have been spawning all over the world. From Metaplanet in Japan to companies like KULR Technology Group, which is trading on the NYSE, companies have been clamoring over deploying capital or raising capital solely to acquire Bitcoin. Even nations like Bhutan and El Salvador have strategic Bitcoin reserves. While these make for cool headlines and set a precedent for market trends, what IS a Bitcoin treasury company?

In short, the main function of a Bitcoin treasury company is to accumulate and manage Bitcoin as its primary reserve asset. It's an entity that is structured to raise capital, manage capital in a transparent way, and strategically deploy capital for the sake of acquiring more Bitcoin, which serves as a focal point of the entity's existence.

It's a vacuum and a holding cell for Bitcoin that looks to maximize gains through operational profits, fundraising, or alternative capital markets such as SPAC.

SPACs, or special purpose acquisition companies, are shell companies that are publicly traded and are solely created to raise capital via IPO, or initial public offering, on the New York Stock Exchange, and have the intent to acquire or merge with another company, allowing private companies to fast-track into public exchanges. This provides faster access to capital, less regulatory friction than a traditional IPO, and generally proves to work for Bitcoin treasury companies, as SPAC investors historically have proven to be bullish on Bitcoin. Anytime a publicly traded company says they are starting a Bitcoin treasury, the stock of the company surges within 24 hours. This is a signal that capital is looking for a new place to go, and that place is Bitcoin. The catch is the Bitcoin treasury company will be required to transparently expose its Bitcoin strategy, risk factors, executive compensation, and accounting method, which is important as the SEC may increase scrutiny regarding SPACs. Why?

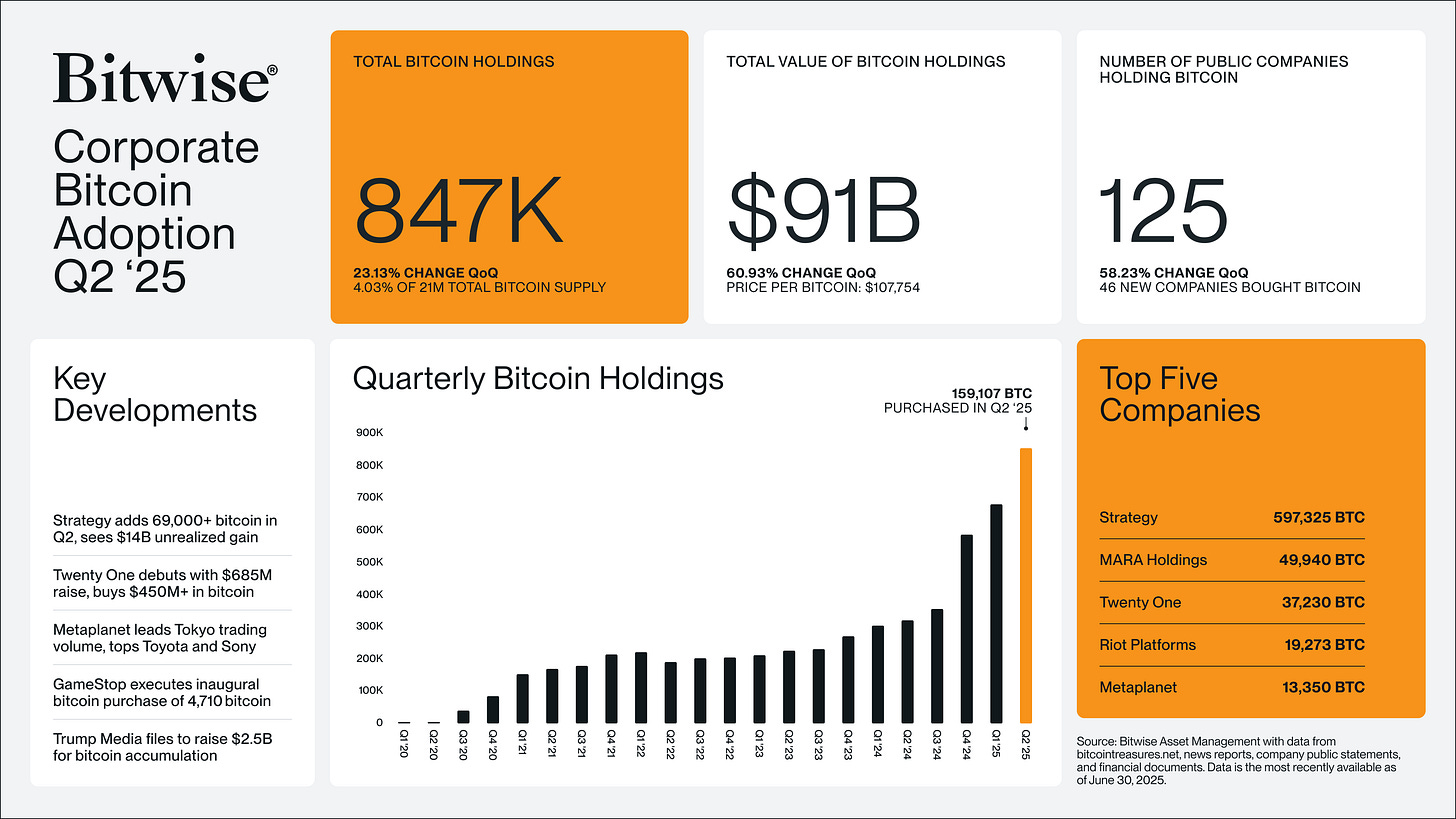

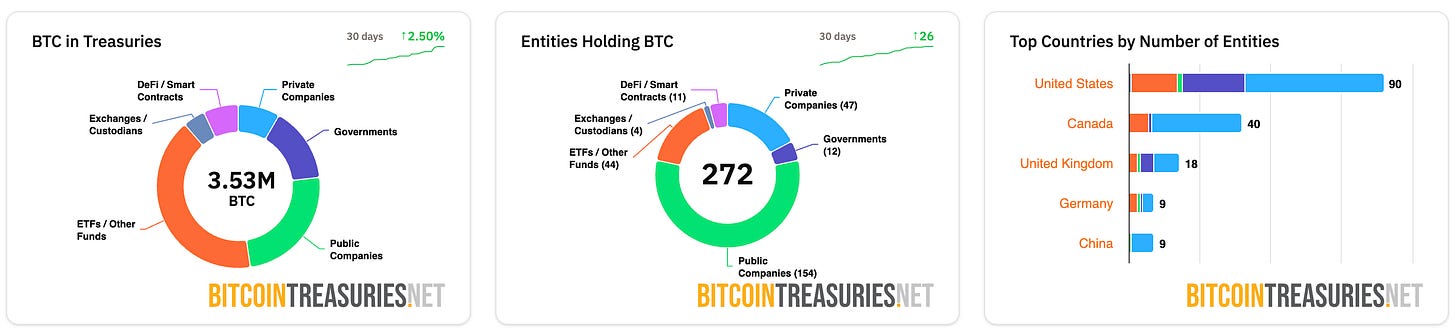

Because a lot more have been popping up. Take a look at BitcoinTreasuries.net to see.

ProCap Financial is being created through a SPAC with Columbus Circle Capital Corp., and it's a $1B merger. The Bitcoin Standard Treasury Company is also looking to go public via SPAC through a merger with Cantor Fitzgerald, which comes with a blank check. What's more interesting is that Cantor Fitzgerald teamed up with SoftBank and Tether to launch TwentyOne, also known as XXI, on the NYSE, and that SPAC came with $3.6B for the sole purpose of buying Bitcoin. (There is no relation to TwentyOne and TwentyOneSociety.) Technically, we were here first, but they beat us to the NYSE.) Lastly, American Bitcoin, which shows Eric Trump as a co-founder and Donald Trump Jr. as a backer, merged with Gryphon Digital Mining. I can keep going.

I think you get the picture; Bitcoin treasury companies and SPACs are best friends. There are also unique ways to leverage SPVs, or special purpose vehicles, for the reason of establishing a Bitcoin treasury company; it’s different than a SPAC. This is a topic that we will touch on in another newsletter, as this is a three-part series.

How it works is you acquire a company with strong cash flow and convert said cash flow reserves into Bitcoin post-acquisition, or you acquire a company that has Bitcoin on its books. Furthermore, a Bitcoin treasury company, once established, may even acquire a Bitcoin mining company to scale faster to vertically integrate into the Bitcoin economy. It all depends on how the BTC will work within the business. Let’s go deeper.

You have to define the business type, form the legal entity, draft a treasury charter with corporate bylaws, open a bank account, sort out Bitcoin custody, have a capital formation plan, acquire the Bitcoin, build internal controls, announce your thesis, create PR comms, ensure your structure is solid for raising money, ensure that leadership is in position, establish how payment will work for the employees, budget for management, and make sure to enjoy the ride! Next week, we are going to comb through this step by step; I'll help you define your Bitcoin treasury’s modus operandi.

With that said, who wants to make a Bitcoin treasury company with me?

— Christopher Perceptions, TwentyOneSociety.com