Happy Selloff?

Why is the US government selling Bitcoin?

Happy New Year! I wish I could have written you all sooner, but I was dealing with a TERRIBLE bug that had me practically bedridden for over two weeks, but I’m back!

Now, let’s talk about what’s happening regarding Bitcoin and nation states:

El Salvador is buying AT LEAST one Bitcoin a day.

Bhutan holds over 30% of its GDP in Bitcoin.

Nations within BRICS, such as China and Russia, are looking to integrate Bitcoin.

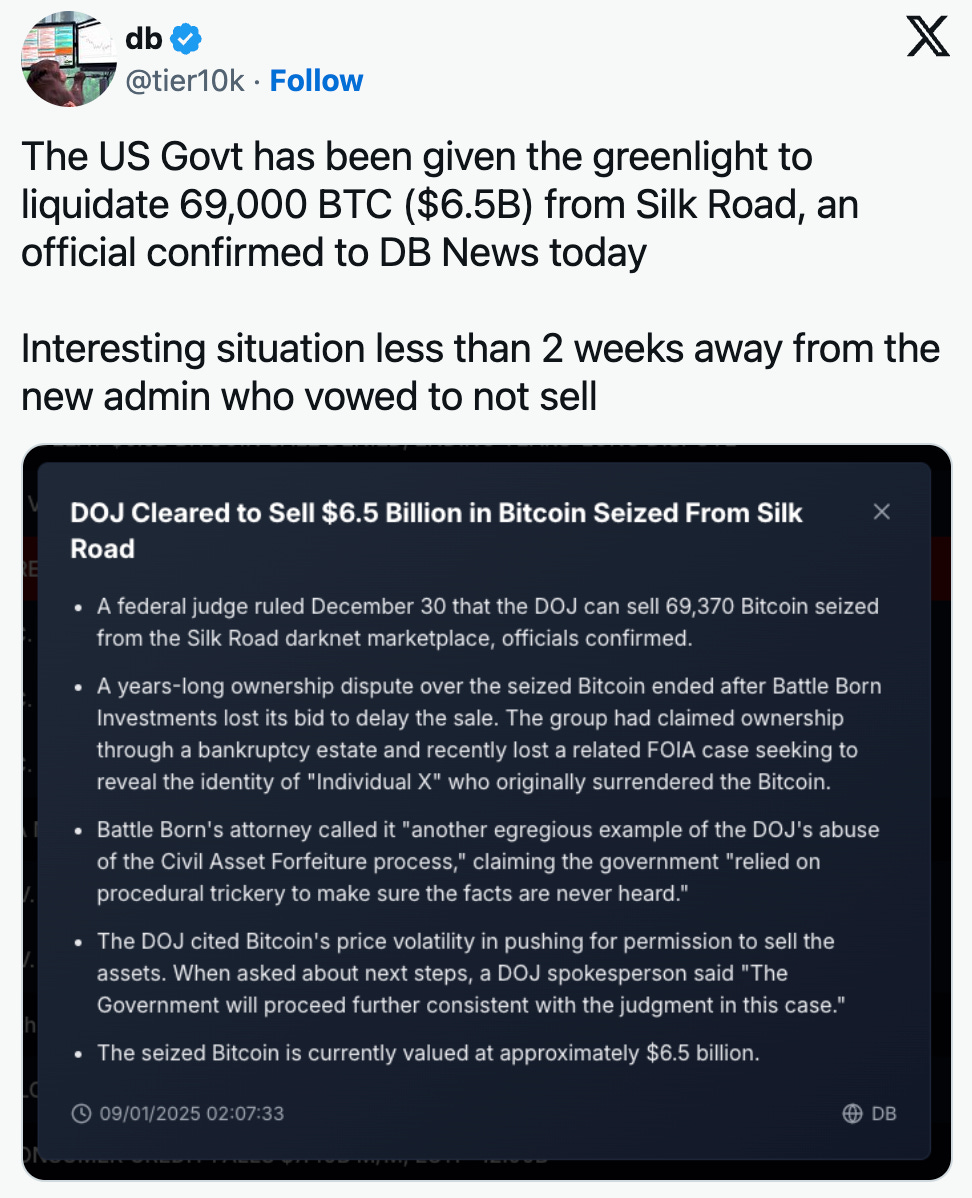

Then, there’s America. What is America doing? Selling Bitcoin. How much Bitcoin? Over 69,000 Bitcoin, which is currently worth $6B+. Billion. What’s crazy is that America holds the most Bitcoin out of any country. The US government currently holds 198,000+ Bitcoin at the time of this newsletter being sent, which is more than any other nation on Earth. Selling 69,000+ Bitcoin would place China on top, as they are projected to hold over 190,000+ Bitcoin.

Why, and what happened to the last nation that sold a vast amount of Bitcoin? Let’s start with how the US acquired the thousands of Bitcoin, then work our way to now.

Back in the day, a website called Silk Road existed on the dark web, and it was like a Craigslist, but for anything. Literally, anything. Hitmen, drugs, etc. It was an anarchist’s paradise. Given the nature of what was being sold, traditional entities such as PayPal and Visa couldn’t be integrated for obvious reasons. So, the Silk Road looked to a pseudo-anonymous decentralized peer-to-peer currency known as Bitcoin. The founder of Silk Road, Ross Ulbricht, ran the site on the dark web from 2011 to 2013, which is the year he was captured. He has been imprisoned ever since, but has a friend in a high place; more on this in a moment. Other than a small auction of Bitcoin, which billionaire Tim Draper took part in to acquire over 20,000 Bitcoin in 2014, the Bitcoin from Silk Road was seized, and it has been held by the US government ever since. While Ross had roughly $25M Bitcoin seized, a person by the name of James Zhong had over 50,000 Bitcoin seized. It’s a crazy story; read it here. The lion share amount of the remaining Bitcoin from Silk Road sat in a Bitcoin wallet held by the US Government. As of December 2024, they got the greenlight to sell the 69,000+ Bitcoin. Why would this happen? One word: pettiness. But I will digress.

It’s no secret that President-elect Donald Trump is “Bullish on Bitcoin” as he spoke to many Bitcoiners at the Bitcoin 2024 conference last year. He made many promises to the Bitcoin community and the crypto community at large. One was that he would free Ross Ulbricht on his first day in office, and the second was that America would form a Bitcoin strategic reserve. The Bitcoin Strategic Reserve Bill, which you can read here, expresses how the US government would acquire 1,000,000 Bitcoin and hold it as a Treasury asset. The current administration of President Joe Biden has been less than friendly to the Bitcoin industry; Van Jones, a die-hard democrat, went viral on Twitter / X as he expressed this was a massive misstep of the Democratic Party as a whole due to millions of voters buy, sell, and/or hold digital assets such as Bitcoin. This could be one final ‘ha’ from the current administration, as the Trump administration would have to start with 69,000 less Bitcoin. Passive aggressive much? There’s no need to sell it.

There was another country that sold all of their Bitcoin and it happened last year, and that country was Germany. In July of 2024, Germany sold roughly 50,000 Bitcoin which was acquired from asset seizures. While the market did not respond favorably in the short term, Germany missed out on seismic gains. The price of Bitcoin during the time of Germany's selloff was roughly $62,000 per Bitcoin. If they had waited a few months, they would have enjoyed the upside of Bitcoin hitting over $102,000 per Bitcoin. The moral of the story is that nation-states should never bet against Bitcoin.

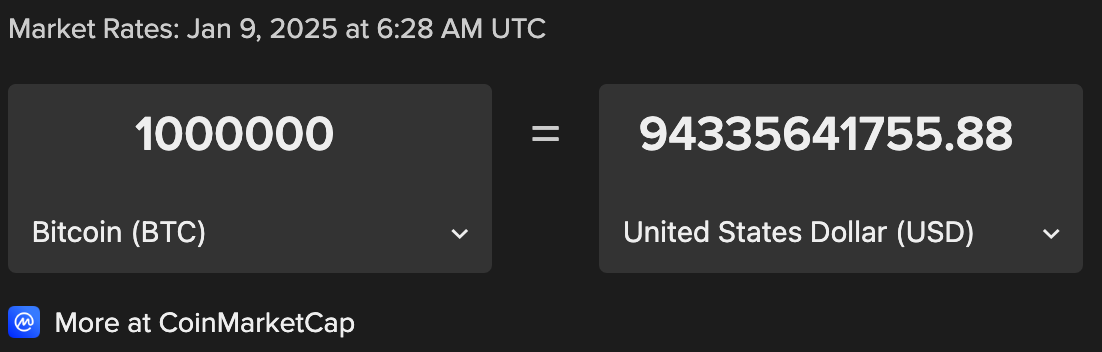

Where does that leave us now? Honestly, it puts the incoming administration in a hard spot because they have to spend more to get to the 1,000,000 amount of Bitcoin. Many may speculate on a market rally where a Strategic Bitcoin Reserve is signed into American law by President-Elect Donald Trump, but many variables are still in play. Is the US government going to approve of printing nearly $100B solely for 1M Bitcoin? How long of a process will this be? Will there be any red tape to getting this done?

Trump loyalist Vivek Ramaswamy is the co-founder of Strive Asset Management, which recently filed with the SEC to launch an ETF aimed at bonds launched by companies that invest in Bitcoin, such as MicroStrategy. The fund will be known as the Strive Bitcoin Bond ETF. Donald Trump’s sons are deeply interested in digital assets and have deployed several offerings onchain, which serves as a signal that this is not just a speed bump to get to the Oval Office but a point of focus and integration.

While it would be interesting to watch what happens at the federal level of the American government, I encourage you to look at what's happening at the state level. States like Wyoming, Florida, Ohio, Texas, Pennsylvania, and more are looking at integrating Bitcoin in some capacity. I can share that Senator Dora Drake and I are even working on something for Wisconsin that may be announced soon. Stay tuned.

— Christopher Perceptions of TwentyOneSociety

Very insightful!