Hillary Clinton made a shocking statement concerning digital assets, also known as cryptocurrencies such as Bitcoin. Mrs. Clinton stated that they could "undermine the role of the dollar as the reserve currency" and even "destabilize nations." Perhaps she thinks that Bitcoin is the intersection of a dystopian apocalypse or an evolution in monetary policy where money is voted on by usage rather than enforcement.

Fast forward to June 2025, and we see that the Trump Administration has taken a very welcoming approach to digital assets, but especially Bitcoin. In Davos, President Trump declares to make the US the world capital of AI and cryptocurrencies. There was conversation around stablecoins, which are digital dollars on blockchains and offered by companies such as Tether via USDT or Circle (which just IPO'd in the States) via USDC. If value has gone digital, stablecoins are the bridge from the old world to the new world. It’s interesting to note that stablecoins have become the belle of the ball rather than Bitcoin in political circles. The GENIUS Act, which I will talk more about in a minute, has more steam behind it than the highly anticipated Strategic Bitcoin Reserve, which currently has an executive order and working group.

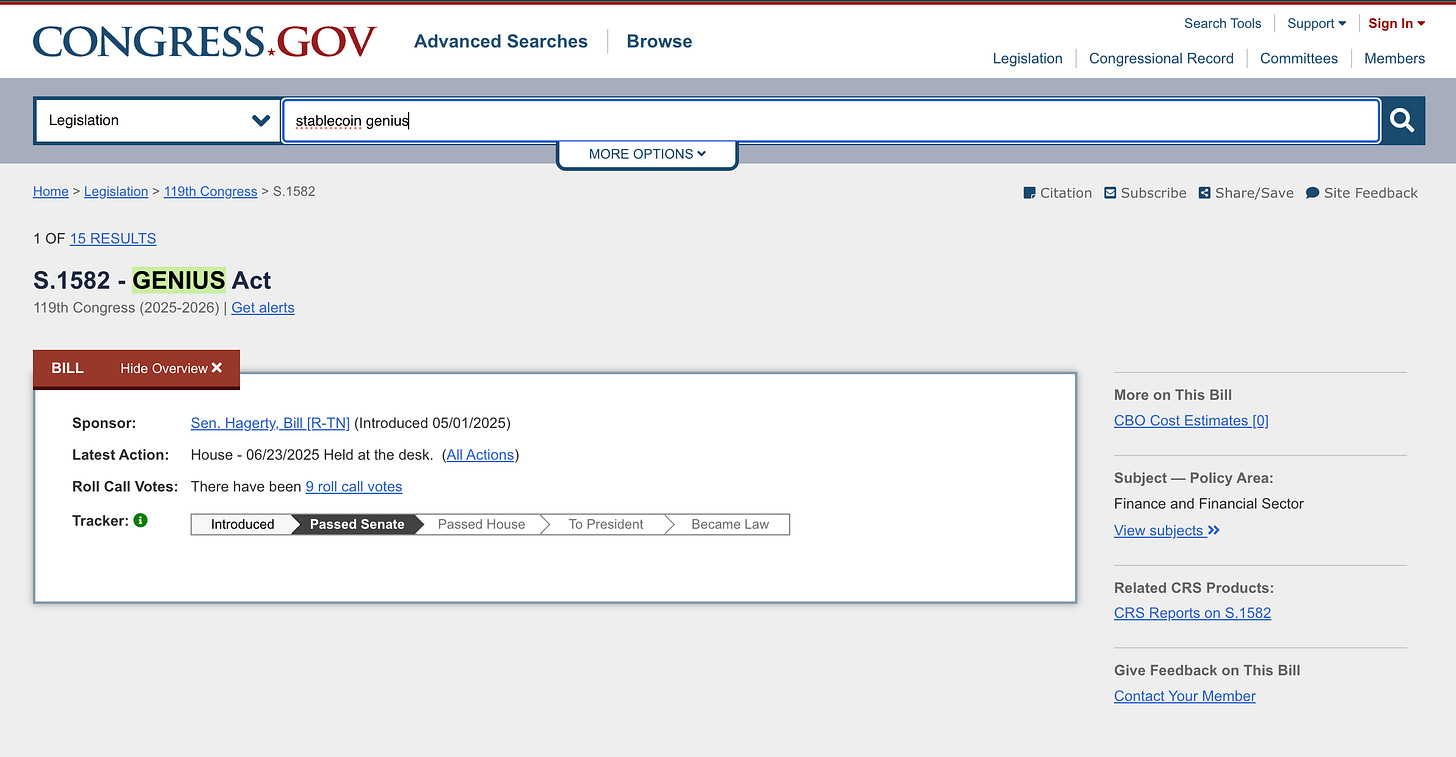

Now, what is the GENIUS Act? Like the WIN Bill in Wisconsin, it is a bill that wants to create a framework around digital assets. The Guiding and Establishing National Innovation of U.S. Stablecoins Act recently passed the Senate with a 68-30 on June 17, 2025; it now moves to the House, where it may merge with another piece of legislation called the STABLE Act. This establishes a framework at a federal level for stablecoins. This serves as a signal to institutions. Regulatory uncertainty has been the last stronghold to break concerning the pathway to adoption in the U.S., and the GENIUS Act can be the spark to a bonfire of opportunity in the industry. When you look at what's at stake, you'll begin to understand why stablecoins are so important to governments that don't want to issue CBDCs, or Central Bank Digital Currencies.

Crypto lending in the DeFi (decentralized finance) space has seen upwards of $60B, or roughly 557,922 BTC at the time of this writing. Couple this with real world assets, also known as RWAs, and you will see why stablecoins are important; they can serve as a form of digital dominance. Would you want a stable ruble, a stable pound, a stable dollar, a stable rand, or a stable yen? The fact that these are going to be offered at scale means monopoly money has moved on the blockchain. Who will win?

Whoever plans for it, welcomes it, incentivizes it, and makes room for it.

— Christopher Perceptions, TwentyOneSociety